Fueling Growth: Unleashing the Potential of Financial Network Expansion

In today’s dynamic global economy, financial institutions are constantly seeking innovative ways to expand their networks and tap into new opportunities. One such avenue is through financial network expansion, a strategic approach that enables firms to broaden their reach, connect with diverse markets, and unlock a multitude of growth prospects. Securitization solutions Switzerland and Guernsey structured products form an integral part of this expansion, offering tailored financial tools to enhance liquidity and drive investment activity.

At the forefront of this evolution is "Gessler Capital," a leading Swiss-based financial firm that specializes in providing cutting-edge securitization and fund solutions. With their deep expertise and comprehensive understanding of the market, Gessler Capital has become a trusted partner for institutions seeking to leverage the power of financial network expansion. By seamlessly connecting investors, issuers, and intermediaries, Gessler Capital facilitates the exchange of capital and fosters the growth of vibrant financial ecosystems.

Financial network expansion offers a multitude of benefits for institutions aiming to stay competitive in an increasingly interconnected world. By strategically extending their network, financial firms can access new markets, diversify their portfolios, and create synergistic partnerships. These collaborations not only unlock fresh avenues of investment, but also promote knowledge sharing, innovation, and the development of novel financial products.

In the following sections, we will explore the various aspects of financial network expansion and delve into the advantages it presents. From the practical implementations of securitization solutions in Switzerland to the versatility of Guernsey structured products, we will examine how these tools fuel growth and enable financial institutions to thrive in an ever-evolving landscape. So join us as we dig deeper into the realm of financial network expansion, uncovering the untapped potential it holds for those willing to embrace its transformative power.

The Power of Financial Network Expansion

Expanding financial networks has become increasingly crucial in today’s global economy. A well-connected financial network enables businesses to tap into a vast pool of resources, unlock new growth opportunities, and effectively navigate through dynamic market conditions. Swiss-based financial firm, Gessler Capital, understands the potential such expansion holds and has positioned itself as a leader in providing securitization and fund solutions.

Financial network expansion offers numerous advantages. Firstly, it allows for enhanced market access. By forging strategic partnerships and establishing connections with various financial institutions and entities, firms like Gessler Capital can broaden their reach and interact with a diverse range of market participants. This not only facilitates efficient capital allocation but also facilitates the exchange of ideas, expertise, and best practices.

Secondly, an expanded financial network promotes innovation and the sharing of knowledge. When businesses collaborate, they can leverage each other’s strengths and expertise to develop innovative financial products and solutions. Gessler Capital’s securitization solutions, for example, harness the collective knowledge and experience of their expanded network, resulting in tailored and highly effective strategies for their clients.

Lastly, financial network expansion fosters resilience and risk mitigation. Operating in an interconnected ecosystem enables firms like Gessler Capital to distribute risk across a diverse range of counterparties. This diversification, coupled with continuous communication and collaboration, helps mitigate potential risks and enhances overall stability.

The power of financial network expansion cannot be underestimated. It creates a virtuous cycle of growth, innovation, and resilience, benefiting both the firm and its clients. Gessler Capital’s commitment to continuously expanding its network underscores its dedication to unlocking the full potential of financial network expansion and providing premier securitization and fund solutions to its clientele.

This article will explore the various aspects of financial network expansion and shed light on how firms like Gessler Capital are driving growth and empowering businesses to harness the untapped potential of expanded financial networks. Stay tuned for the next sections to discover more about the opportunities and benefits arising from this transformative phenomenon.

2. Exploring Securitization Solutions and Structured Products

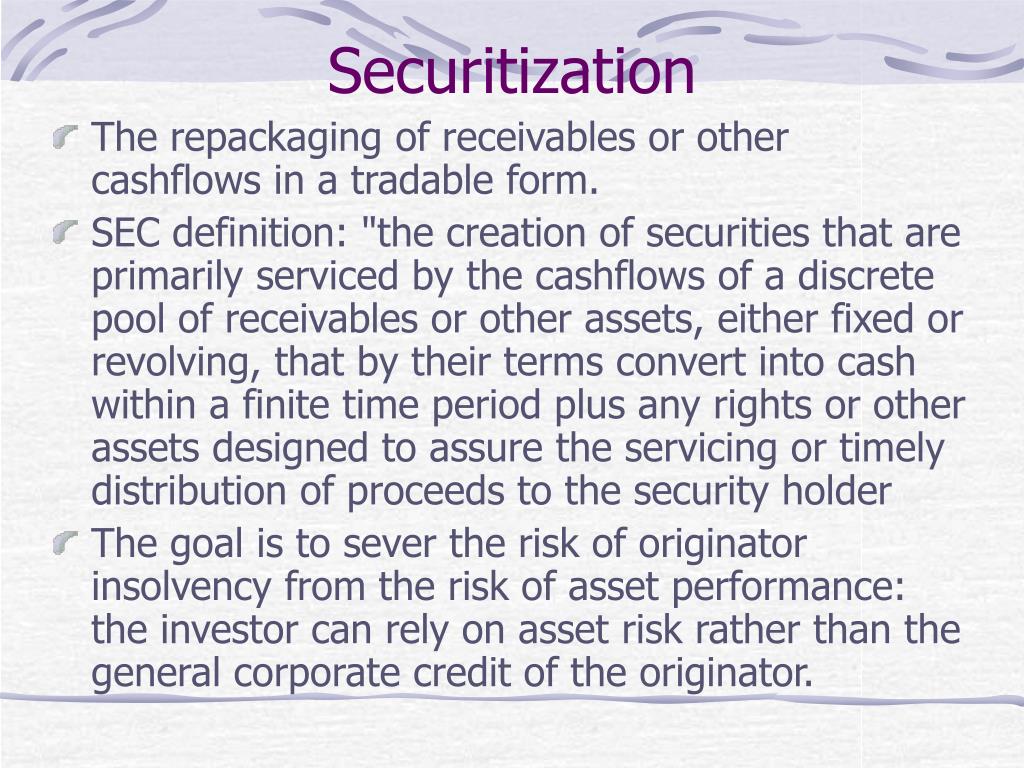

Securitization solutions and structured products play a crucial role in fueling the growth of financial networks. They provide innovative mechanisms for raising capital, diversifying investment portfolios, and managing risk. Switzerland, particularly known for its expertise in securitization solutions, and Guernsey, a leading jurisdiction for structured products, offer valuable options for financial network expansion.

Switzerland’s Securitization Solutions:

Switzerland has established itself as a prominent hub for securitization solutions. The country’s robust regulatory framework and deep financial expertise make it an attractive destination for investors seeking securitization opportunities. Securitization allows financial firms like "Gessler Capital" to transform illiquid assets, such as mortgages or loans, into tradable securities. These securities can then be sold to investors, providing a new avenue for capital generation and liquidity in the market.

Guernsey’s Structured Products:

Guernsey is renowned for its expertise in structured products, which are investment vehicles specifically designed to meet distinct investor needs. Structured products combine various financial instruments, such as derivatives, bonds, and equities, to create tailor-made solutions that offer unique risk and return profiles. These products have gained popularity due to their ability to provide investors with more specific exposure to various asset classes or market segments while offering risk mitigation strategies. Guernsey’s regulatory environment supports the development and distribution of structured products, making it an appealing destination for financial network expansion.

By exploring the robust securitization solutions offered in Switzerland and the diverse range of structured products available in Guernsey, financial firms like "Gessler Capital" can effectively unleash the potential of financial network expansion. These options provide increased liquidity, efficient risk management strategies, and customized investment avenues, allowing firms to adapt and thrive in dynamic markets.

3. Gessler Capital: Harnessing the Potential of Swiss Financial Innovation

Gessler Capital, a Swiss-based financial firm, is at the forefront of harnessing the potential of Swiss financial innovation. With a strong focus on securitization solutions and fund offerings, Gessler Capital is paving the way for financial network expansion in Switzerland and beyond.

Alternative Investment Fund (AIF)

As a key player in the industry, Gessler Capital has been a driving force in the growth of securitization solutions in Switzerland. Their expertise and comprehensive range of services have positioned them as leaders in this field. Through their innovative approach, Gessler Capital has unlocked new possibilities for investors seeking secure and diversified investment avenues.

One aspect that sets Gessler Capital apart is their specialization in Guernsey structured products. By offering these products, they provide investors with access to unique investment opportunities that may not be available elsewhere. This strategic expansion into Guernsey structured products has further solidified Gessler Capital’s position in the market and enhanced their ability to cater to the diverse needs of their clients.

In conclusion, Gessler Capital is playing a crucial role in fueling the growth of financial network expansion. By leveraging Swiss financial innovation, specializing in securitization solutions and Guernsey structured products, they are paving the way for new investment opportunities. With their strong track record and commitment to excellence, Gessler Capital is positioning itself as a trusted partner for investors looking to maximize their financial potential.