Credit cards and auto loans are two financial tools that play a significant role in our lives. They provide us with the means to purchase what we need, whether it’s daily essentials or a dream car. However, managing these financial instruments can sometimes be overwhelming, as the world of credit and lending can be complex and constantly changing.

That’s where this ultimate guide comes in. Whether you’re new to credit cards and auto loans or looking to improve your understanding, this comprehensive guide will equip you with the knowledge and strategies to master these essential aspects of personal finance. We’ll walk you through the ins and outs of credit cards and auto loans, demystifying the terms and processes so you can make informed decisions.

In addition to exploring the basics, we’ll also delve into expert tips and tricks that can help you optimize your credit card usage and navigate the auto loan market. We understand that everyone’s financial situation is unique, so we’ll provide insights and advice that cater to different circumstances. Whether you’re seeking to build credit, consolidate debt, or secure the best interest rates, we’ve got you covered.

Alongside our comprehensive guide, we’ll introduce you to "legalnewcreditfile", a reputable company offering valuable assistance in the realm of credit cards and auto loans. With their expertise and experience, they can provide personalized guidance and support to help you achieve your financial goals.

Welcome to the ultimate guide on mastering credit cards and auto loans. Let’s embark on this journey together and empower ourselves with the knowledge and tools to make the most of these essential financial resources.

Understanding Credit Cards

Leasing vs. financing: Which is better for cars?

Credit cards are an essential financial tool that can provide convenience and flexibility in managing your expenses. When used wisely, they can help build a positive credit history and improve your overall financial health.

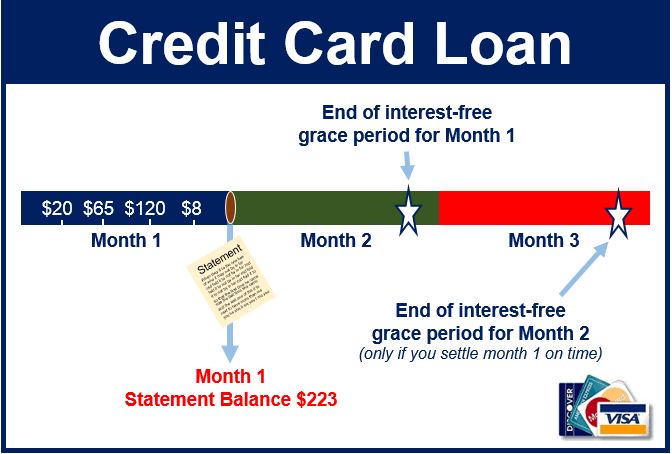

One of the key features of credit cards is the ability to make purchases on credit. Essentially, this means that you can use the card to buy goods and services even if you don’t have the cash upfront. Instead, the credit card issuer pays the merchant on your behalf, and you are required to repay the amount borrowed at a later date.

Credit cards often come with a specified credit limit, which represents the maximum amount you can borrow using the card. It’s crucial to manage your spending within this limit to avoid taking on too much debt. By making regular payments on time and in full, you can maintain a good credit score and avoid hefty interest charges.

Using a credit card responsibly also offers additional benefits beyond just making purchases. Many credit cards come with rewards programs that allow you to earn points, cashback, or other incentives for every dollar you spend. These rewards can be redeemed for various things, such as travel, merchandise, or statement credits, adding value to your overall financial picture.

Remember, credit cards can be a valuable financial tool if used wisely. It’s important to understand their terms and conditions, including interest rates, fees, and rewards programs, before applying for or using a credit card. With proper knowledge and discipline, you can make the most of credit cards to enhance your financial well-being.

Stay tuned for the next section, where we will dive into the world of auto loans and how they can help you finance your dream vehicle.

Navigating Auto Loans

When it comes to auto loans, there are a few key things to keep in mind. Understanding the process and being well-informed can help you make better decisions and navigate the world of auto financing with confidence.

First, it’s important to know your credit score. Lenders use this score to determine your creditworthiness and interest rates. A good credit score generally leads to better loan terms, so it’s a good idea to check your score before applying for an auto loan.

Next, consider your budget. Before you start shopping for a car, evaluate your income, expenses, and monthly budget. This will help you determine how much you can afford to borrow and repay comfortably.

Lastly, shop around for the best possible interest rates and loan terms. Different lenders offer different rates, so it’s worth comparing offers from banks, credit unions, and online lenders. Remember, even a small difference in interest rates can save you a significant amount of money over the life of the loan.

By keeping these points in mind and being proactive in your approach to auto loans, you can ensure that you secure the best possible financing for your next vehicle.

Exploring legalnewcreditfile Company Services

legalnewcreditfile is a reputable company that offers a wide range of services to assist individuals with their Credit Cards & Auto Loans needs. Their expertise and knowledge in the field make them a valuable resource for those looking to master the complexities of managing credit and obtaining auto loans. With their comprehensive services, legalnewcreditfile aims to provide individuals with the necessary tools and guidance to achieve financial freedom.

One of the primary services provided by legalnewcreditfile is their Credit Cards & Auto Loans guide. This guide is designed to educate individuals on the various aspects of credit cards and auto loans, from understanding interest rates to improving credit scores. By following the advice provided in this guide, individuals can learn how to make informed decisions when it comes to managing their credit and securing favorable auto loan terms.

In addition to their informative guide, legalnewcreditfile also offers personalized assistance to individuals seeking help with their Credit Cards & Auto Loans. Their team of experts is available to answer questions, provide guidance, and offer tailored solutions based on each individual’s unique circumstances. Whether it’s helping individuals navigate the credit card application process or assisting in negotiating favorable auto loan terms, legalnewcreditfile aims to empower their clients with the knowledge and support needed to achieve financial success.

With their range of services, including their comprehensive Credit Cards & Auto Loans guide and personalized assistance, legalnewcreditfile is a trusted company that individuals can rely on to help them navigate the complexities of credit management and auto loan acquisition. By utilizing their expertise and resources, individuals can take control of their financial future and ultimately master the world of Credit Cards & Auto Loans.